This article provides a comprehensive guide on how to identify and avoid pump-and-dump schemes

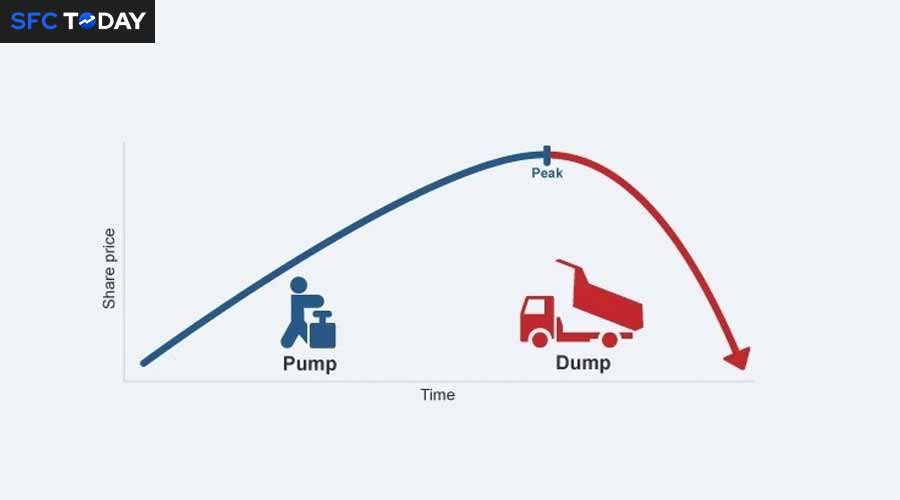

The financial markets offer opportunities for substantial returns, but they also harbor risks, including fraudulent schemes designed to manipulate prices for the benefit of a few at the expense of many. Among these schemes, the “pump-and-dump” is particularly notorious. A pump-and-dump involves artificially inflating the price of an asset through false or misleading statements, only to sell off holdings at the peak, leaving other investors with significant losses. This article provides a comprehensive guide on how to identify and avoid pump-and-dump schemes, ensuring you can protect your investments from these fraudulent activities.

Understanding Pump-and-Dump Schemes

A pump-and-dump scheme typically involves the promotion of a stock or cryptocurrency to inflate its price (“pump”) followed by the orchestrators selling off their shares at the high price, causing the price to crash (“dump”). These schemes are illegal in many countries because they rely on deception to manipulate market prices and exploit unsuspecting investors.

Key Characteristics of Pump-and-Dump Schemes:

Exaggerated Claims: Promoters of pump-and-dump schemes often make exaggerated or false claims about the asset’s potential. These can include unverified news about breakthroughs, upcoming partnerships, or supposed insider information.

Aggressive Promotion: The asset is aggressively promoted through various channels, including social media, email campaigns, online forums, and even direct messages. The aim is to generate hype and attract a large number of buyers.

Sudden Price Surge: As more investors buy into the hype, the asset’s price experiences a rapid and significant increase, often without any substantial underlying reason.

Sharp Decline: Once the orchestrators of the scheme sell off their holdings, the price plummets rapidly, leaving latecomers with worthless or significantly devalued assets.

Common Venues for Pump-and-Dump Schemes

Pump-and-dump schemes are more common in certain markets and types of assets, particularly those that are less regulated and more susceptible to manipulation.

Penny Stocks: Historically, pump-and-dump schemes have been prevalent in the penny stock market. Penny stocks are low-priced, thinly traded stocks of small companies. Their low liquidity makes them easy targets for price manipulation.

Cryptocurrencies: The rise of cryptocurrencies has created a new breeding ground for pump-and-dump schemes. Many cryptocurrencies are lightly regulated, and their prices can be extremely volatile, making them attractive to fraudsters looking to exploit unsuspecting investors.

Over-the-Counter (OTC) Markets: Securities traded on OTC markets often lack the same level of regulation and transparency as those listed on major exchanges, making them more vulnerable to manipulation.

How to Identify Pump-and-Dump Schemes

Recognizing the signs of a pump-and-dump scheme can save you from significant financial losses. Here are some red flags to watch for:

1. Unusually High Trading Volume

One of the first indicators of a potential pump-and-dump scheme is a sudden spike in trading volume without any corresponding news or developments to justify the increased interest. If a stock or cryptocurrency suddenly sees a large influx of buyers, it may be a sign that it is being manipulated.

2. Exaggerated Promotions

Be wary of assets being promoted with overly optimistic claims that seem too good to be true. Statements like “this stock is guaranteed to double in a week” or “this cryptocurrency is the next Bitcoin” should raise immediate red flags. Genuine investment opportunities are rarely promoted with such fervor.

3. Lack of Fundamental Information

Legitimate investments are usually supported by solid financials, business models, and credible management teams. If you cannot find credible information about the asset or the company behind it, this is a strong indicator that it may be part of a pump-and-dump scheme.

4. Suspicious Social Media Activity

Fraudsters often use social media to spread misinformation and generate hype. If you see a sudden influx of posts, tweets, or comments promoting an asset, particularly from accounts that have little history or credibility, this could be part of a coordinated pump-and-dump effort.

5. Price Movements Not Supported by News

If the price of an asset is rising rapidly without any corresponding news, earnings reports, or other tangible reasons, it could be due to artificial inflation by manipulators. Legitimate price increases are typically driven by positive developments, not rumors or speculative hype.

6. Lack of Transparency

Legitimate companies are usually transparent about their operations, financial health, and future prospects. If an investment opportunity is shrouded in secrecy or if the company has a history of non-disclosure, it could be a sign of fraudulent activity.

Steps to Avoid Falling Victim to Pump-and-Dump Schemes

Avoiding pump-and-dump schemes requires a combination of due diligence, skepticism, and a disciplined approach to investing. Here are some steps you can take to protect yourself:

1. Conduct Thorough Research

Before investing in any asset, conduct comprehensive research to understand the fundamentals. Look into the company’s financial statements, management team, business model, and industry position. For cryptocurrencies, research the project’s whitepaper, development team, and use cases. If reliable information is difficult to find, this is a significant red flag.

2. Be Skeptical of “Hot Tips”

Be cautious when receiving unsolicited investment tips, especially from unknown sources. This includes tips received via social media, email, or even from friends who may have been misled themselves. Always verify the information from multiple credible sources before considering any investment.

3. Avoid Herd Mentality

The fear of missing out (FOMO) can drive people to invest in assets that are experiencing rapid price increases. However, this herd mentality is precisely what pump-and-dump orchestrators rely on to inflate prices. Instead of following the crowd, focus on making informed decisions based on thorough analysis.

4. Diversify Your Investments

Diversification is a key strategy to mitigate risk in any investment portfolio. By spreading your investments across different sectors, asset classes, and geographies, you can reduce the impact of any single asset’s poor performance. Even if you inadvertently invest in a pump-and-dump scheme, a diversified portfolio can help minimize the damage.

5. Pay Attention to Trading Volume and Market Cap

Low trading volume and market cap can make an asset more susceptible to manipulation. Be cautious when investing in assets with low liquidity, as they are often targets for pump-and-dump schemes. Higher liquidity generally indicates a more stable and reliable investment.

6. Use Reputable Exchanges and Brokers

When trading stocks or cryptocurrencies, use reputable exchanges and brokers that adhere to regulatory standards. These platforms often have mechanisms in place to detect and prevent market manipulation. Avoid trading on obscure or unregulated platforms, as they may be more prone to fraudulent activities.

7. Stay Informed About Regulatory Changes

Regulations around securities and cryptocurrencies are continually evolving. Stay informed about the latest regulatory developments in your jurisdiction, as well as international regulations that could impact your investments. Understanding the legal landscape can help you avoid investments that are likely to be targeted by regulators.

8. Implement Stop-Loss Orders

A stop-loss order is a tool that automatically sells an asset when its price falls to a predetermined level. This can help limit your losses if an asset’s price starts to decline rapidly. While stop-loss orders cannot protect you from all losses, they are a valuable tool in managing risk, especially in volatile markets.

9. Avoid Penny Stocks and Low-Cap Cryptocurrencies

Penny stocks and low-cap cryptocurrencies are common targets for pump-and-dump schemes due to their low price and liquidity. These assets are often touted as “hidden gems” with massive upside potential, but they are highly speculative and prone to manipulation. Focus on established companies and cryptocurrencies with a track record of stability.

10. Consider Long-Term Investments

Long-term investments based on strong fundamentals are generally safer than short-term speculative trades. Pump-and-dump schemes typically target short-term traders looking for quick profits. By focusing on long-term value, you are less likely to be swayed by temporary price fluctuations and the false promises of manipulators.

Legal and Regulatory Protections

In many countries, pump-and-dump schemes are illegal, and regulators actively pursue those who engage in such practices. The U.S. Securities and Exchange Commission (SEC), for example, has strict rules against market manipulation and has prosecuted numerous cases involving pump-and-dump schemes.

1. Role of Regulatory Agencies

Regulatory agencies such as the SEC in the United States, the Financial Conduct Authority (FCA) in the United Kingdom, and the European Securities and Markets Authority (ESMA) in the European Union play a crucial role in monitoring and enforcing laws against market manipulation. These agencies can impose fines, suspend trading of manipulated securities, and prosecute individuals involved in fraudulent activities.

2. Reporting Suspected Pump-and-Dump Schemes

If you suspect that a pump-and-dump scheme is underway, you can report it to the relevant regulatory authority. Most agencies have online portals where you can submit tips anonymously. Providing detailed information, such as suspicious trading activity, names of individuals involved, and communication records, can help regulators take swift action.

3. Legal Recourse for Victims

Victims of pump-and-dump schemes may have legal recourse to recover their losses. In some cases, class-action lawsuits are filed against the perpetrators of the scheme, allowing victims to seek compensation collectively. Additionally, if the perpetrators are prosecuted, courts may order restitution to compensate the victims.

Staying Vigilant in the Investment World

Pump-and-dump schemes represent a significant threat to investors, particularly in markets that are less regulated or involve high levels of speculation. By understanding the characteristics of these schemes, conducting thorough research, and maintaining a disciplined investment approach, you can protect yourself from falling victim to these fraudulent activities.

The financial markets will always attract individuals looking to exploit others for personal gain. However, with the right knowledge and tools, you can navigate these markets with confidence, making informed decisions that align with your financial goals. Staying vigilant, skeptical, and informed is the best defense against pump-and-dump schemes, ensuring that your investments are based on solid fundamentals rather than the manipulative tactics of fraudsters.

As financial markets and technologies continue to evolve, new forms of pump-and-dump schemes may emerge. It is essential to stay updated on the latest trends and regulatory developments to safeguard your investments. Whether you are investing in traditional stocks or the burgeoning world of cryptocurrencies, the principles of thorough research, diversification, and skepticism remain key to avoiding the pitfalls of pump-and-dump schemes.