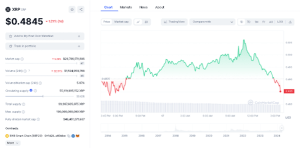

In a surprising move, Ripple, the cryptocurrency giant, offloaded 100 million XRP tokens into a bearish market this past Sunday. The sale comes during a period of increased market volatility, with XRP prices experiencing a significant decline of 20.16% over the past 7 days, further sinking by 20.06% over the last 30-days. The current trading price stands at approximately $0.4845, marking a decrease of 1.21% in the last 24 hours.

Ripple Puts 100 Million XRP Into A Sinking Market Amidst Recent Crash; Analyst Forecasts A Massive XRP Price Prediction https://t.co/barxhR4BfA

— 🇳🇱 MackAttackXRP® 🇳🇱 67K-XRP-Followers (@MackAttackXRP) April 15, 2024

This recent transaction by Ripple adds to the market’s unease, particularly as it coincides with escalating geopolitical tensions between Iran and Israel, which have contributed to broader market uncertainties. The large-scale sale has raised eyebrows within the investment community, prompting concerns over its potential impact on XRP’s already declining price.

XRP Price chart (CoinMarketCap)

Ripple’s market position remains strong despite these challenges, with a market cap of $26.70 billion, making it the seventh-largest crypto by this metric. Over the last 24 hours, the volume of XRP traded accounted for 33% of the total market cap, indicating a high level of liquidity.

Ongoing Legal Challenges with the SEC

Compounding the market’s challenges are the continuing legal proceedings between Ripple and the U.S. Securities and Exchange Commission (SEC). The dispute, which centers around allegations of Ripple’s non-compliance with U.S. securities laws, is approaching critical milestones. Ripple is preparing to file its opposition brief by April 22, followed by a redacted version two days later. The SEC will then have until May 6 to respond with its reply brief.

This isn’t just the SEC vs. Ripple case; it’s a collaboration between the SEC and Ripple to suppress XRP and manipulate its market. #Ripple #SEC #XRP pic.twitter.com/6nJzDbJ8v1

— WallStreetBulls (@w_thejazz) April 16, 2024

In their opening brief, the SEC has argued for a disgorgement of $2 billion from Ripple and seeks to restrict its ability to sell XRP to institutional investors, citing ongoing sales post-complaint as a breach of U.S. securities law. The upcoming briefs from both sides are pivotal, as they will address these allegations in depth.

Amid these legal proceedings, a final pretrial conference was held on April 16, presided over by Judge Sarah Netburn. Such conferences typically allow for discussions on potential settlements under judicial guidance, though a settlement appears unlikely given the SEC’s intentions to appeal the Programmatic Sales of XRP ruling.

XRP Price Analysis

XRP is currently trading at a critical juncture. The token has found strong support at approximately $0.4800. If this level breaks, there is potential for further declines. Conversely, should the price hold and reject further downward movement, there is a possibility for a rally toward the $0.5800 resistance zone.

Source: Tradingview

The decisions in the coming weeks will likely have significant implications for XRP’s market behavior. Investors and analysts alike are closely monitoring these developments, as they could set precedents for how cryptocurrencies are regulated and traded in the future.