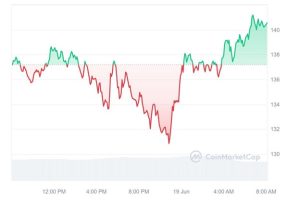

Well known as the Ethereum Killer, Solana has seen its price fall under bearish pressure in recent weeks after facing rejection from a bullish technical pattern resistance zone. As of press time SOL is trading at $140.65 which is up 3.27% in the last 24 hours. However this short-term bounce masks underlying weakness in the crypto since it has lost 6.91% in the last 7 days.

SOL Price Chart: CoinMarketCap

In the last 24 hours its trading activity has dropped by 11% and is now currently at $3 billion while its market cap at $64.7 billion.

On May 21st SOL recorded a high of $188 after facing rejection from a bullish pennant resistance level. A pennant is a continuation pattern that signals a pause in the prevailing trend before the previous move resumes. In Solana’s case the pennant was bullish suggesting higher prices were on the horizon.

However the bullish outlook shifted in the last few hours on June 18th when SOL price broke down and closed below the pennant support. This breakdown suggested that bearish momentum had taken over from the previous bullish trend and today price looks to be trading bullish to retest the newly formed resistance

SOLUSD Daily Chart: TradingView

Technical indicators confirm the bearish technical picture for SOL. The daily Relative Strength Index (RSI) is currently at 38 showing bearish momentum and nearing oversold levels below 30 which can precede a bounce. Meanwhile the Moving Average Convergence Divergence (MACD) indicator saw a bearish crossover with the MACD line shifting below the signal line – a bearish signal.

If prices can dip lower, it is more likely to dip to the horizontal support level at around $125

Digging into on-chain data highlights reasons behind SOL bearish momentum. According to DefiLlama the Total Value Locked (TVL) on Solana has dropped from around $4.9 billion on June 5th to the current $4.183 billion. A lower TVL tends to associate with reduced demand and pricing pressure.

Source: DeFiLlama

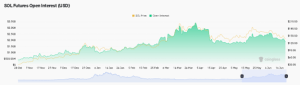

Open interest (OI) data from Coinglass shows the Solana futures OI has declined from $2.58 billion on June 5th to $1.85 billion currently. Falling OI can mean further price drops as it signals lower trading volumes and conviction among the whales.

Source: Coinglass

According to forecasting site ChangellySolana prediction, their model currently signals a bearish market sentiment of 66% and 34% bullish.

Looking out to year-end 2024 projections Changelly expects the SOL price to trade between $124.25 on the downside and up to $145.46 at highs. Their year end average price target is $166.67.

In summary, while Solana has seen a gain of 2.34% bounce today the overall technical picture appears bearish after its breakdown from a bullish pennant pattern. Key support to watch is the $125 level with a clear MACD crossover adding to downside risks. On-chain data is also weakening and with lower TVL and futures OI hinting at reduced demand.