Shiba Inu has recently shown signs of a strong rebound as the crypto market begins to recover from its downturn. The meme coin, widely known for its volatility and community-driven initiatives, has seen its price surge to $0.0000271. This comes on the back of a massive 260% increase in the burn rate, resulting in over 31.3 million SHIB tokens being removed from circulation in the last 24 hours.

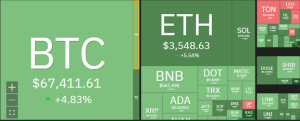

The significant token burn, a deflationary mechanism intended to reduce supply and potentially increase the token’s value, has been a primary driver of this uptick. CoinMarketCap data underscores the positive sentiment, indicating a 4.61% rise in price and a corresponding 7.70% increase in market capitalization to $15.97 billion, placing SHIB as the 11th largest cryptocurrency by market cap.

SHIB Resurges Above $0.0000270 Following a Bullish Shift on Short-Term Charts

Shiba Inu (SHIB) price analysis on the 4-hour chart shows the token has been trading just above the key support level at $0.00002678.SHIB is showing signs of consolidation after a recent uptick. This level has been critical in preventing further downside and suggests a potential platform for the price to build upon.

Looking at the moving averages, SHIB is hovering around the 20 EMA (Exponential Moving Average) of $0.00002741, which often acts as a dynamic resistance or support level. A decisive move above this line could signal strengthening momentum.

The Bollinger Bands, which help to measure market volatility, show that SHIB’s price is stabilizing after recent fluctuations, indicated by the narrowing of the bands around the current price level.

The 2-hour chart provides a more bullish outlook, with the immediate resistance present at the $0.00002829 mark. Should the price surpass this level, it might encounter another resistance near $0.00002806.

The MACD (Moving Average Convergence Divergence), an indicator that traces the momentum and potential trend reversals, hints at a positive crossover, as the MACD line (blue) appears to be edging upwards toward the signal line (orange). This could be a precursor to increasing buyer interest. Moreover, the RSI (Relative Strength Index) at 52.93 shows that SHIB is neither overbought nor oversold, giving room for potential movement in either direction without immediate pressure from market sentiment.

SHIB’s price buying action a marked rise from the lows of $0.00002592. The green candlesticks on the graph show a steady climb, with minor fluctuations suggesting healthy trading volume and consistent buying pressure. The increase in trading volume to over $1.7 billion further substantiates the coin’s momentum, likely influenced by the recent token burns.