Shiba Inu (SHIB) price today shows a promising uptrend as it breaks out of a prolonged consolidation phase, signaling a strong bullish momentum. After closing above the critical resistance of $0.0000253, SHIB’s price action indicates a readiness to target higher levels. The cryptocurrency has seen a modest gain of 0.68% in the last 24 hours, with its current price standing at $0.000026 USD. The breach of this key resistance level suggests an increase in buyer pressure that could set the stage for further gains.

SHIB On-Chain Metrics and Market Sentiment

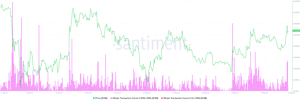

On-chain data provides a backdrop of increasing institutional interest, as evidenced by the Whale Transaction Count index during the recent consolidation phase. This metric, which tracks transactions over $100,000, has shown significant spikes, indicating that larger investors are accumulating SHIB, especially during dips.

This accumulation suggests a strong support level at the current lows, adding credibility to the bullish outlook. However, investors remain vigilant as any significant downturn in market sentiment could push SHIB below the $0.0000210 support level, potentially invalidating the bullish forecast and triggering a deeper correction to $0.0000168.

Stability Above Key Support Level of $0.0000210, Showing Market Resilience

Today’s Shiba Inu (SHIB) trading session demonstrates a pattern of resilience and potential for recovery within a volatile market. Currently, the price hovers above $0.000025 level, showing a slight decrease of 0.26% in the last 24 hours. Despite this minor drop, the significant increase in trading volume, up by 29.35% to reach $1.22 billion, indicates heightened investor activity and interest.

This surge in volume suggests that while the price has slightly declined, the overall market participation has increased, potentially setting the stage for upcoming price movements.

The technical analysis of Shiba Inu reveals critical insights into its market behavior. The 24-hour trading range has been relatively tight, with SHIB fluctuating between minor high and low points. This suggests a consolidation phase, which might precede a more substantial price movement.

The market cap slightly decreased by 0.26% to $15.15 billion, reflecting the minor price dip yet maintaining a strong market presence. The Volume/Market Cap ratio stands at 8.07%, underlining the active trading compared to the total market valuation, which is a positive sign for potential volatility and dynamic price action.

As Shiba Inu continues to navigate through these market conditions, investors and traders should keep a close eye on the $0.0000268 resistance and $0.0000252 support levels. Breaking past these could either confirm a bullish recovery or a bearish downturn, respectively.