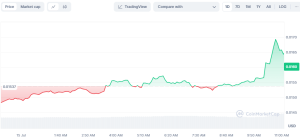

Over the last 24 hours, Notcoin (NOT) has risen in price. The cryptocurrency has changed to the upward side from $0.01537 to $0.01613, gaining 5.38%. The development in the chart shows that this upsurge comes after consolidation or a downtrend. That move has been rather explosive, with trading volume spiking by 51.52%.

NOT/USD 1-day price chart (source: CoinMarketCap)

Since the higher volume of trading would reflect higher investor interest, it also might help in sustaining the current upward movement. Also, the market capitalization in NOT has grown by 5.27%, reaching #52 in the ranking markets.

Technical Analysis and Key Levels

From the chart, it can be seen that after a time of consolidation, there has been a sharp rise in price. Prior to this most recent move, price had been consolidating in a very tight range. This was the consolidation area from which the breakout has now produced the current run-up in price.

The support and resistance areas are the key to future prices. The previous resistance, near $0.0155, should now be acting as a support level. The next significant resistance is expected to be at around the recent high of $0.01613. If it clears this latter level of resistance, then its rise may continue with the next resistance at $0.0220 after the formation of a falling wedge.

Market Sentiment and Indicators

This shows a huge surge in volumes along with a hike in prices, which tells about some sort of bullishness in the counter. Furthermore, Notcoin’s technical support to this fact is being derived. In the chart below, price has moved above the 100-period Exponential Moving Average, and often this scenario highlights that a shift in momentum from bearish to bullish may develop.

Further, an inverse head-and-shoulder formation clearly indicates a potential bullish reversal. This pattern, defined with three troughs, with the middle one set lower, implies that in case the price breaks above the neckline at around $0.017, it could target much higher, around $0.031.

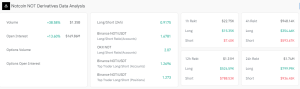

Source: Coinglass

The NOT derivatives market is also getting hot. The trade volumes have surged to 38.58%, indicating high interest with a number of speculators willing to buy the native token. Open interest, which can be defined as the total number of derivative contracts not settled and which still remain active, increases by 13.60%. This coupled with a rising price is an indicator that new money is entering the market—hence bullish.

Ecosystem Developments and Future Outlook

Notcoin’s recent developments within its ecosystem also played a role in price determination. The team has been actively building up its ecosystem by working on NFT projects with The Open Network, besides developing new features, like an “Explore” feature on its Telegram app.

This bodes well for the demand for NOT tokens, given that developers have to own NOT tokens in order to engage with the network.

Notcoin has also worked with other DeFi pioneer 1inch and Sequoia-supported attestation protocol Sign to launch the “Triangle” accelerator program. This program is designed to attract developers to build the TON ecosystem; in its essence, it bridges Web2 and Web3 applications by increasing their utility and demand for NOT tokens.