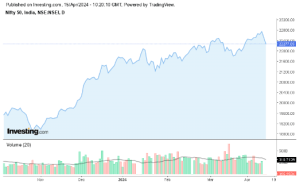

The Indian stock market opened this week today, April 15th, on a slightly bearish note, as major indices showed a decline. The NIFTY is so far down 1.10% at 22,271.55, while the BSE SENSEX has fallen 1.11% to trade at 73,421.21 as of writing. Investors are likely exercising caution ahead of this important week, with several major companies set to declare their fourth-quarter financial results this week between April 15th and April 21st. The upcoming announcements from giants such as Infosys, Wipro, and Reliance Industries are particularly in focus, setting the stage for potentially market-moving news.

Nifty 50 Chart: Investing.com

Tata Consultancy Services Ltd (TCS)

Post-results trading for TCS showed a downturn as the stock has dropped by 1.54% to Rs 3,939.75, following a report of earnings that met expectations but perhaps left some investors wanting more. The IT major, having reported its Q4 results on Friday, has seen its shares trading within a daily range of Rs 3,919.05 to Rs 4,064.20. Despite today’s decline, TCS maintains a strong yearly performance, remaining significantly above its 52-week low of Rs 3,070.25. It also records a good market cap of 14.26T INR

Infosys Ltd

Infosys, another titan in the IT sector, has seen its shares decline by 1.03% to trade at Rs 1,469.45. As the second-largest IT firm in India, Infosys is nearing its earnings announcement on the backdrop of challenging global market conditions. The stock’s movement within the day has ranged from Rs 1,461.05 to Rs 1,491.95. Investors are likely keeping a close eye on how Infosys will perform, especially after crossing the US$100 billion market cap milestone in 2021. Today, It records an impressive market cap of 6.07T INR.

Hindustan Unilever Ltd

In the consumer goods sector, Hindustan Unilever’s stock has fallen by 1.68%, trading at Rs 2,194.90 as of writing. The company, known for its vast array of products spanning from foods to personal care, has traded a daily and its 52-week low of Rs 2,190.00 today. The broader market downturn and possible concerns over consumer spending may be influencing investor sentiment toward stocks like Hindustan Unilever. However, it records a Market cap of 5.15T INR

ICICI Bank Ltd

ICICI Bank, a leader in the financial services sector, has recorded one of the steeper declines, with its stock price dropping by over 2.35% to Rs 1,078.45. The bank, which has a significant presence across India, has seen its shares trade near the lower end of the day’s range of Rs 1,076.60 to Rs 1,106.15 as of writing. Banking stocks have been under pressure and ICICI Bank’s movements reflect broader concerns about interest rates and economic forecasts.

Reliance Industries Ltd

Reliance Industries is the largest public company in India by market capitalization and has also experienced a minor dip of 0.19% to trade at Rs 2,928.65. As a conglomerate with diverse interests across sectors, Reliance’s performance is often viewed as a bellwether for the Indian economy. Today’s relatively stable performance amidst broader market declines could suggest investor confidence in its diverse portfolio.Reliance Induastries records a market cap of 19.84T INR.

HDFC Bank Ltd

HDFC Bank saw its shares decrease by 1.63% to trade at Rs 1,494.20. As India’s largest private sector bank by assets, HDFC’s movements are closely watched. The bank has traded between Rs 1,493.25 and Rs 1,510.00 throughout the day so far, reflecting the tight range seen in other banking stocks amid uncertain economic signals.

As the week progresses, the focus will remain on how these key players report their earnings. The anticipation builds not only for the numbers themselves but for what they will indicate about the broader health of the Indian economy and specific sectors.