Ether price has sent mixed signals since the launch of spot Ethereum ETFs that many expected would push the altcoin into price discovery.

ETH is down 6.5% since July 23 when the ETFs were launched, fueled primarily by the high capital outflows from these investment products. However, things could be looking up for Ether’s price as flows into the spot Ethereum ETFs turn positive.

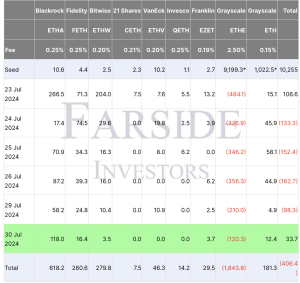

Data from Farside Investors reveals that the nine U.S. spot Ethereum exchange-traded funds saw net inflows of $33.67 million on July 30, ending a four-day streak of negative flows.

Spot Ethereum ETF flows table. Source: Farside Investors

The Grayscale Ethereum Trust (ETHE) was the only spot ether ETF to log negative flows, with $120.28 million being withdrawn from the fund.

The total daily trading volume of these spot ether products amounted to $563.22 million on Tuesday, down from $773.01 million on Monday and $933.86 million on Friday.

ETH is down 1.02% over the past 24 hours to change hands at around $3,312 at the time of writing.

The layer-1 token was fighting resistance from the $3,400 area, embraced by both the 50-day exponential moving average (EMA) and the 100-day EMA. a daily candlestick close above this level would see the price rise to confront resistance from the psychological level at $3,500. Overcoming this level will take ETH price higher to revisit the May 27 range high around $4,000. Such a move would represent a 19% uptick from the current price.

ETH/USD daily chart. Source: TradingView

On the downside, the relative strength index (RSI) was moving in the negative region at 49, suggesting that the market conditions still favoured the downside.

As such, a drop below the ascending trendline at $3,240 would spell doom for Ethereum holders with the next line of defense arising from the local low at $3,085. ETH’s downside could be capped at $3,000 in the short term.