Bitcoin has maintained a solid bullish stance over the past week, with its price testing and surpassing previous weekly highs. Opening at $58,500, Bitcoin peaked at $64,879 before settling above the $63,000 mark, where it remained for the rest of the week.

This steady rise in Bitcoin’s price, punctuated by multiple peaks and minor corrections, signals intense buying pressure and sustained interest from market participants. However, the daily chart reveals a more volatile journey, with Bitcoin experiencing fluctuations despite overall gains.

Source: CoinMarketCap

As of press time, Bitcoin was trading at $63,770, a slight 0.25% decline from its recent highs.

Optimistic Outlook from Analysts

Zooming out, Bitcoin has a track record of gaining strength after reclaiming its accumulation range, a pattern that traders and analysts watch closely. This historical trend fuels growing optimism among market participants, keenly anticipating a potential breakout above crucial resistance levels.

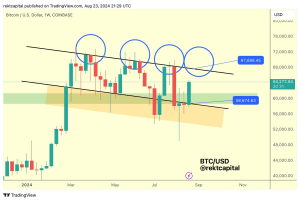

A prominent voice in the crypto community, Rekt Capital, recently offered a hopeful perspective on Bitcoin’s current price action. According to the analyst, Bitcoin has moved past its downside deviation and now teeters on the edge of reclaiming its weekly re-accumulation range, signaling a possible new phase of upward momentum.

History has repeated

The downside deviation is over

The bargain-buying period has ended

Bitcoin is on the cusp of confirming a reclaim of its Weekly Re-Accumulation Range$BTC #Crypto #Bitcoin https://t.co/DWREJ7NBjq pic.twitter.com/6FmRvBlJaF

— Rekt Capital (@rektcapital) August 24, 2024

If confirmed, this reclaim would signal the end of the bargain-buying period and the beginning of a new uptrend. Rekt Capital also highlighted that Bitcoin is primed to challenge its diagonal resistance, which has kept the cryptocurrency bearish since March.

Source: X

The analyst pointed out that as long as Bitcoin trades above the $61,500 mark going into the new weekly close, the first week of the cross-channel ascent is likely already underway. As BTC currently trades at $63.77K, Rekt Capital further believes that the uptrend has resumed, positioning Bitcoin to sustain its ascent after its earlier dip to $48,000.

Potential Resistance and Support Levels

Other analysts, however, do not share the optimism and warn that Bitcoin still has some work to do before confirming its downtrend end. This includes CrypNuevo, another famous trader who considered the possibility that Bitcoin could be directed toward support levels that would lead to the liquidation of late longs.

The expert pinpointed the crucial levels as being at exactly $63,500 and $62,200 on the 1-hour and 4-hour charts with respect to the 50-period exponential moving average (EMA). In CrypNuevo’s view, declining these levels might result in the “Bart Simpson” pattern wherein Bitcoin falls back towards its 50-period EMAs.

If we do a full analysis on the liquidations, we can notice a few things:

• The Delta liquidations is approaching a risky level that could lead to a long squeeze – a drop to liquidate some longs.

• The levels with more liquidations are $63.5k (1h50EMA) & $62.2k. pic.twitter.com/JUdOUbVVuz

— CrypNuevo 🔨 (@CrypNuevo) August 25, 2024

According to the trader, this potential drop would flush out delta liquidations with a long squeeze to support, setting the stage for a renewed upward push. Other traders in the community, including Trader ELM, echoed similar sentiments, predicting a dip to $62,700 before any upward continuation.

However, Crypto Chase offered a counterpoint, suggesting that buying clean retests after Bitcoin pumps historically has a low success rate. The trader noted that when Bitcoin is ready to break out, it rarely offers clean retests, implying that the current bullish momentum might not provide many opportunities for retracement.

Source: X

Crypto Chase added that a breakout above $65,700 would be a more definitive sign of bullish momentum. Conversely, if Bitcoin retests the $60,000-$61,000 range, traders should closely monitor how price action responds to determine whether to long for another test of daily resistance around $65,000 or short towards $57,500.