The cryptocurrency world is with anticipation as the highly-awaited Bitcoin halving event draws near. In just a matter of hours, this momentous occasion will unfold, marking a significant milestone in the evolution of the world’s leading digital currency.

For those unfamiliar with the concept, the Bitcoin halving is a pre-programmed event that occurs roughly every four years. It is a mechanism built into the Bitcoin protocol to regulate the supply of new coins entering circulation. During a halving, the reward for miners who validate transactions and add new blocks to the blockchain is cut in half. The imminent halving will see the block reward for miners reduced from 6.25 BTC to 3.125 BTC. This decrease in rewards has historically triggered a supply shock, as fewer newly minted bitcoins are introduced into the market. Consequently, the halving events have often been followed by significant price rallies in the past.

The forthcoming halving, slated to take place at block 840,000, marks the fourth such event in Bitcoin’s history. As of this writing, only 95 blocks remain until this pivotal moment, and the crypto community is holding its collective breath in anticipation of the potential ripple effects.

96 blocks remaining till halving👀💥#Bitcoin $BTC #BTChttps://t.co/NiX0g6F2CL

— Johnny Woo | Never DM you for Money (@j0hnnyw00) April 19, 2024

Beyond the technical aspects, the Bitcoin halving carries profound psychological significance for the digital currency’s ardent supporters. It is widely regarded as a symbolic milestone, heralding the onset of a period of heightened activity and interest in the Bitcoin ecosystem.

As the halving approaches, the Bitcoin network is already experiencing a surge in transactions, with investors and enthusiasts alike eager to participate in this historic event. The halving’s impact on the broader cryptocurrency market remains to be seen, but many analysts anticipate a flurry of narratives and speculative fervor in the days, weeks and months that follow.

BTC Technical Analysis and Price Movements

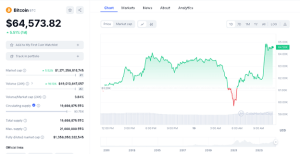

In the lead-up to the halving, Bitcoin’s price has exhibited volatility, recently dipping below the $60,000 mark before swiftly recovering to trade at around $64,577 at the time of writing. This price movement was not directly related to market dynamics or internal shifts within the cryptocurrency ecosystem but was instead spurred by geopolitical tensions between Israel and Iran.

BTC Data Chart (CoinMarketCap)

With a market capitalization of over $1.27 trillion and a circulating supply of 19,686,875 BTC, Bitcoin continues to dominate the cryptocurrency landscape. However, its price trajectory remains uncertain, as the halving event’s impact could potentially drive prices in either direction.

Technical analysis suggests that the price faced rejection below the $60,000 mark at an ascending trendline. While the halving effect could rally prices upwards, potentially leading to a retest of the ascending trendline lying above or the resistance support at $71,786, a breach below the current trendline support level could open the door for the wide range of fair value gap below it and a potential pullback to the demand zone at $52,700 zone. Will these confluences act as a strong magnet to pull prices lower amid the halving event today? This remains not clear, as the halving event’s impact could drive prices in either direction.

BTCUSD Price Chart (TradingView)

Ultimately, the halving event’s significance may overshadow technical analysis as the market grapples with the supply shock and the psychological implications of this historic occasion. Regardless of the short-term price movements, the Bitcoin halving stands as a testament to the digital currency’s innovative design and its ability to capture the imagination of investors and enthusiasts worldwide, with its price prediction and trajectory poised to gain intensively in the long term.