Worldcoin (WLD) has been bearish with the price declining in the recent past as the market influences the coin. As of press time, WLD had fallen by 3.39% to trade at $2.71. This decline is part of a broader downtrend, with the price dropping from a high of $2.80.

WLD’s Market capitalisation has also been seen to decline by 3%, and is currently at $695,046,443 making it rank 97th in the market. However, the 24-hour trading volume has risen by 8.65%, to $141,406,065 showing that trading has picked up as traders continue to buy the dip.

Technical Chart Analysis of Worldcoin

On the WLDUSD price chart, a bearish pennant pattern. This pattern would appear as a sharp fall followed by the consolidation phase, which hints at more continuation of the trend on the downside. Key support levels can be viewed around Bottom 1 and 2, where the prices consolidated for a while before continuing within the pennant. The projected target on the bearish breakout is slightly above $3.00, suggesting the price might decline.

MACD is still below the signal line and trending lower, reinforcing the bearish run of the security. Currently, the Chaikin Money Flow (CMF) came out to be -0.14, which confirms a great deal of selling pressure. The RSI is at 41.29, below the neutral level of 50, though still not in the oversold territory, giving the stock some space to extend its downside further.

Market Sentiments and Indicators

The increased trading volume amid the price decline suggests sell-side solid pressure. An increasing volume when the price is starting to decrease at a slower pace near the end of the trading session may suggest that accumulation or buying interest may be taking place within those low price levels.

However, general market sentiment is pessimistic considering the latest price movements and the bearish technicals, which include a bearish pennant and negative technical indicators of significant importance. There is a need for caution, watching out for potential breakout points and risk management strategies, among them the setting of stop-loss orders to prevent undue losses.

Implications for Traders and Investors

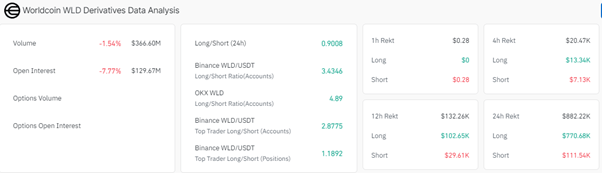

Data from derivatives market also suggest slightly declining speculative activity. The trading volume of WLD derivatives has reduced by 1.54% to stand at $366.60 million, thereby indicating a reduction in the interest to trade in the short term. Simultaneously, open interest has also been shaved off by 7.77% to reach $129.67 million.

This fall in the open interest could suggest profit-booking and liquidation of some positions by traders, possibly as they lose confidence that the market will continue in this direction or response to bearish price action.

For traders, the current market conditions portend preparations for continuing the bearish trend. Short positions can be considered on bounces to the resistance levels, particularly around the recent high of $2.80. For risk to be kept in check, stop-loss orders should be placed slightly above this resistance. Only if signs of stabilization or reversals are seen in the price action should long-term investors consider possible entry points, mainly since the fundamentals of this coin have remained relatively strong and broader market conditions have stabilized.