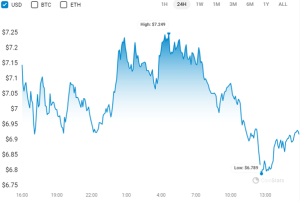

Toncoin (TON) has been on the decline, dropping under $7 after not being able to break the $8 barrier. The price drop of the altcoin is as a result of negative market sentiments in the cryptocurrency market. The previous trading sessions depicted Toncoin’s price trying to bounce back from $6.6 to $8.1 but failed to sustain the gains. At the time of writing, the price stands at $6.92, which is 16.21% below its all-time high and 3% in the red in the last 24 hours.

Bearish Indicators and Moving Averages

From the technical perspective, the most likely short-term outlook for Toncoin remains bearish. At the moment, the cryptocurrency is trading below key moving averages, with the 50-day Moving Average acting as a dynamic support and resistance level.

The Relative Strength Index (RSI) for Toncoin is at 33.25 to 36.19, indicating that the asset may be in the oversold region. Often, such a situation signals that the asset may be undervalued, which means that if the bullish conditions are met, the price may grow.

However, the MACD lines are slightly below the zero level which shows bearish sentiment with the signal line being above the MACD line.

On-Chain Metrics and Long-Term Holder Confidence

However, since the technical indicators are bearish, investors holding Toncoin can find some hope on the on-chain metrics. For instance, 84% of all TON holders are ‘In the Money,’ meaning that they bought their tokens at a price that is lower than the current market value. This implies that the market is still very much bullish among the long-term holders of the coin.

Also, trading volumes have increased, suggesting that investors are more active and interested in the market

The Toncoin ecosystem is also proving to be quite resilient. According to DeFi Lama, the current TVL of Toncoin’s DeFi ecosystem is above $940 million, which puts it at the 11th position among all networks. Furthermore, the number of TON addresses has grown significantly, which indicates the increasing popularity of the network.

Potential Catalysts and Future Outlook

However, a release of TapSwap a Telegram-based tap-to-earn platform is expected to play a role in boosting the price of the token. TapSwap has chosen Toncoin as the blockchain to work with due to its high speed and low cost of transactions. The platform has more than 50 million users worldwide and has seen an increase in user activity, which may indicate its impact on Toncoin’s price.

The TD Sequential has issued a buy signal on the #Toncoin four-hour chart, predicting a rebound of one to four candlesticks for $TON! pic.twitter.com/pYxghSUwwE

— Ali (@ali_charts) June 18, 2024

Crypto analyst Ali Martinez has offered insights into possible future price direction of Toncoin. He sees Toncoin as having 40% upside potential, which could push the price of the asset up to $11.

But Martinez notes that the TD Sequential indicator points to a potential drop to fill liquidity before another uptrend. The levels to watch include the $6.78 that has acted as a bottom level that has halted the price from continuing its downward trend and the $8.17 resistance level.