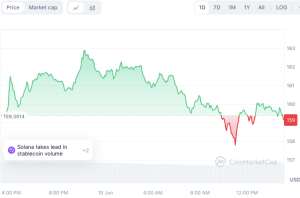

Solana (SOL) has been registering crucial recovery symptoms over the past 24 hours, with the price retaking the critical $160 level, indicative of a 6% rise over the weekend. This move has been in a broader context of erratic market conditions which was influenced by indicators about the state of the external economy, in particular, the US NFP jobs data.

Concurrently, there has been immense volatility in the crypto market, which resonated with the NFP jobs data from the US. Lately, Solana and most of the significant cryptocurrencies were forced into price correction. Still, prices for Solana recovered rapidly, regaining almost half the losses toward the end of June 10.

The fast recovery of Solana prices was met by very decent activity within the open interest trends. Though there was a very short-term dip in open interest, it was at $2 billion, meaning that investment holders were rather aggressive with the Solana cryptocurrency. It remained a relatively strong metric for the bullishness of Solana, considering that market participants have repeatedly pointed out that longs are still being positioned for an eventual push higher.

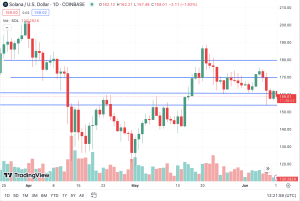

Solana Technical Analysis and Price Outlook:

Following the first drop to as low as $153 the price action from Solana reflected an attempt for a quick recovery toward the $160 level. This comes against rising open interest to top a 20-day peak of $2.58 billion registered on June 5. The immediate technical resistance level was near the $165 zone for Solana, an area aligned with the 10-day Simple Moving Average.

A confirmed breakout above this resistance level could support more significant upside potential, possibly testing levels near $180 in the short term. On the other hand, a break on the upper side provides clues that Solana may consolidate with a possible price swing between a narrow range of about $155 and $170.

Market Activity and Sentiment

With the growth in users and associated DEX volume, the underlying power of the Solana network can be seen. Trading volumes and active wallets have increased and recently outpaced those on more established platforms, like Ethereum, for several days running. This expanding activity is not only testifying to Solana’s efficiency and attractiveness within the DeFi space but will represent a vote of confidence in the project’s long-term potential.

More rumors in the air are about possible institutional interest, such as the spot Solana ETF by the investment firm BlackRock, which also is instrumental in shaping market sentiment. Now, with the novelty and volatility of Solana, such an ETF will probably face roadblocks to its approval. However, if approved this would increase the visibility and access of the mainstream investor into the cryptocurrency hence a bullish outlook.