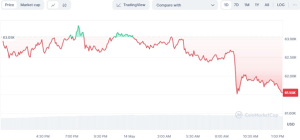

Bitcoin’s (BTC) price has been in a downtrend, posting a decline of 1.87% over the past 24 hours. As of the latest update, Bitcoin is trading at $61,767.96 with a 24-hour trading volume of $25,663,376,982. The current market conditions reflect a growing bearish momentum, impacting the overall sentiment in the cryptocurrency market.

BTC/USD 24-hour price chart (source: CoinMarketCap)

Market Reaction to US Inflation Data

The recent dip in Bitcoin’s price coincides with traders anticipating key U.S. inflation data set to be released this week. The Producer Price Index (PPI) is expected on Tuesday, followed by the Consumer Price Index (CPI) on Wednesday. These data points are crucial as they could provide insights into the Federal Reserve’s next moves regarding interest rates.

Recent U.S. economic indicators suggest a slight slowdown, with April’s employment data revealing weaker growth than expected. This has led to speculation that the Federal Reserve might cut rates to prevent an economic downturn.

🇺🇸U.S. ECONOMIC DATA THIS WEEK:

*PPI INFLATION (TUES.)

*CPI INFLATION (WED.)

*RETAIL SALES (WED.)

*NY FED MANUFACTURING INDEX (WED.)

*JOBLESS CLAIMS (THURS.)

*PHILLY FED MANUFACTURING INDEX (THURS.)

*BUILDING PERMITS (THURS.)

*HOUSING STARTS (THURS.)

*INDUSTRIAL PRODUCTION… pic.twitter.com/GY6vfAnqh6— Investing.com (@Investingcom) May 12, 2024

The CME’s FedWatch tool currently forecasts a 24.6% chance of a rate cut at the July Federal Open Market Committee (FOMC) meeting and a 48.6% chance in September.

Technical Analysis and Market Sentiment

Bitcoin’s recent price action has shown increased volatility. Over the past 24 hours, BTC has traded between $60,799.61 and $63,422.66, settling at $61,911.31. Concurrently, Bitcoin has recorded losses of 3.59% and 4.30% over the past week and month, respectively.

Analysts have noted a potential trend reversal, with Bitcoin forming an inverse head and shoulders pattern on the four-hour chart. This technical formation suggests that a break above the trendline could lead to further price recovery. However, significant resistance around the $63,500 and $63,700 levels could hinder upward momentum.

Impact of Coinbase Outage &Post-Halving Recovery

Bitcoin’s price decline also coincided with a system-wide outage reported by Coinbase, the largest U.S.-based cryptocurrency exchange. The outage, which affected transactions and withdrawals, may have contributed to the immediate price drop. BTC’s price fell from $62,700 to $61,450 in minutes following the outage announcement.

guys coinbase is completely down & america won’t realize for 6 more hours

do with this what you will pic.twitter.com/tjmRrIU5Z8

— CryptoFinally (@CryptoFinally) May 14, 2024

Coinbase assured users that all funds were safe, but the incident underscores Bitcoin’s vulnerability to operational issues on major exchanges. The price drop from yesterday’s peak of $63,400 highlights the ongoing volatility and market sensitivity to news events.

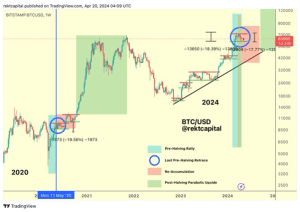

Bitcoin has recently emerged from the post-halving “danger zone,” a period characterized by heightened volatility following the halving event on April 20, 2024. Despite a sharp decline below $60,000 last month, Bitcoin has shown resilience, recovering to current levels above $60,000.

Historically, the post-halving period is marked by increased volatility, often leading to significant price swings. Analysts have observed similar patterns in past cycles, with Bitcoin showing a consistent recovery after the initial dip. This trend suggests that Bitcoin might be entering a re-accumulation phase, potentially leading to further price stabilization and growth.

The broader cryptocurrency market is also influenced by macroeconomic factors, regulatory developments, and market sentiment. The upcoming inflation data, coupled with potential policy changes by the Federal Reserve, could introduce new waves of volatility.