The Chainlink (LINK) cryptocurrency has recently experienced significant volatility reflective of the broader cryptocurrency market’s fluctuations. As of the latest data, LINK’s price is recorded at $14.53 with a substantial 24-hour trading volume of $302,933,780. Despite a modest increase of 0.16% within the last day, the cryptocurrency’s performance continues to be influenced by a variety of market dynamics and technical indicators.

Impact of Recent Product Updates on LINK

Chainlink’s market response was notably impacted by the first quarter of the 2024 product update, primarily due to the introduction of the Chainlink Cross-Chain Interoperability Protocol (CCIP) to the public. This development signifies a pivotal advancement within the Chainlink ecosystem, offering potential long-term growth and enhanced market positioning.

Chainlink’s recent price actions reveal a strategic bounce above a critical 170-day support level as of April 13. However, following this rebound, LINK encountered significant resistance, raising concerns about the sustainability of its upward trajectory. Currently, the cryptocurrency is balancing at crucial support levels, both horizontal and diagonal, which will likely determine the immediate future direction of its price.

A deeper look into LINK’s technical setup shows a key support at $14.50, which is vital for short-term price stability. This support level is characterized by a horizontal support area and the lower boundary of an ascending parallel channel, shown on the six-hour chart. The upcoming market reactions to this support level will be crucial in deciding whether LINK is poised for a downward correction or if it will continue its climb.

Should LINK’s price drop below this support, it could potentially trigger a correction phase leading to prices as low as $11.50. Conversely, a successful bounce from this support level could initiate a bullish trend, possibly driving the price above the $20 threshold.

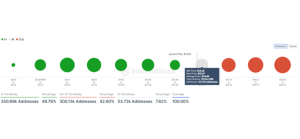

Despite recent gains, LINK’s upward progression faces substantial hurdles. There exists a significant on-chain resistance zone ranging from $15.57 to $19.22, identified by heavy purchasing activities within this price range. This resistance was evident when LINK’s price attempted to surge but peaked at $16.03 before declining, underscoring the difficulties in sustaining higher price levels.

Analyzing Chainlink’s Long-Term Trends

From a broader perspective, LINK’s market activity over the past year has been characterized by a significant five-wave increase starting in June 2023, extending over 275 days. This was followed by a sharp 47% price correction within a brief 34-day period, aligning with the 0.618 Fibonacci retracement level—a commonly observed reversal point in technical analysis. This suggests that the long-term correction phase might be nearing its end, setting the stage for a potential upward movement.

The technical indicators on the daily chart provide a cautiously optimistic outlook. The Moving Average Convergence Divergence (MACD) has just crossed into bullish territory, suggesting that momentum might be turning in favor of the bulls. Similarly, the Relative Strength Index (RSI) has surpassed its downtrend line, potentially signaling increasing buying interest.

Despite recent gains, LINK faces significant resistance ahead. A cluster of on-chain resistance lies between $15.57 and $19.22, where a substantial volume of LINK was purchased, as indicated by the In/Out of the Money indicator. This area may pose a challenge to upward movements, as evidenced by the recent rejection that saw LINK’s price fail to hold gains, topping out at $16.03 before receding.

The sentiment in the Chainlink market remains cautiously optimistic, buoyed by recent product developments. Chainlink’s update on the Cross-Chain Interoperability Protocol (CCIP), which is now generally available, could provide a significant boost to LINK’s utility and adoption. This development might influence investor confidence positively, potentially leading to increased demand and upward price action.

The recent price movements and technical indicators suggest a pivotal moment for Chainlink’s price trajectory. While recent developments such as the CCIP release contribute to the overall bullish sentiment, key support and resistance levels will determine whether LINK can sustain its upward momentum or undergo further corrective moves.