Bitcoin (BTC) price has lately been under pressure and has dropped below the $60,000 mark which is a significant level for traders and investors as support. In the last 30 days, the cryptocurrency has lost more than 10% of its value, with the current trading price at $59,530, which is 4% down in the last 24 hours. This price movement has raised the eyebrows of the market players, especially since Bitcoin was relatively stable in the first half of the month.

Source: CoinMarketCap

Whale Activity and Market Reactions

Another reason that may have contributed to the current bearish trend of Bitcoin is the behavior of large investors or ‘whales’. A transaction of 2,300 BTC worth $142.24 million was made, transferring the tokens to the Kraken exchange. Such movements may suggest the intention to sell, which is normally perceived as bearish for the market.

However, the whale still holds 18,141 BTC, and if the assets are sold, it may put more pressure on Bitcoin’s price.

Source: CryptoQuant

Furthermore, liquidations have been influenced by the Celsius platform that has been repaying its creditors in the course of its bankruptcy case. This has resulted in many liquidations in the leveraged crypto derivatives, with total trades reaching almost $335 million within a single day, which only adds more pressure to the decline of Bitcoin’s price.

Technical Analysis and Future Outlook

The volatility of Bitcoin in the recent period has attracted the attention of technical analysts who believe that the digital currency could be in a consolidation phase within a narrowing range. These consolidations could be forming a trending “cup and handle pattern, if it complete, it might lead to a bullish breakout.

Some traders have observed that the current trading range of Bitcoin is the handle, which has formed over the last three years. Furthermore, the Relative Strength Index (RSI) has recently entered the oversold zone on the daily chart, which suggests that bitcoin could experience a short-term correction within the next 24 hours.

Source; TradingView

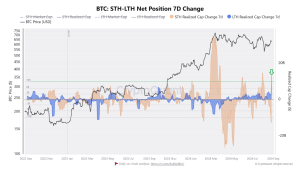

The actions of these long-term investors who have purchased over $10 billion of bitcoin are of particular interest. In the past, these holders are not likely to sell during the short-term volatility of the markets, which could be positive for the price. Additionally, the price of Bitcoin has also been seen to dropped below the 200-day moving average, which is a long-term trend indicator.

However, trading below this level is considered bearish, and if Bitcoin stays below the 200-day MA, it may signify more downside. As a result, the following major support is at $55,000 which if broken might lead to further decline in the price of Bitcoin.

Market Sentiment and External Influences

Other factors have also affected the overall perception of Bitcoin, such as the anticipated stance of the U.S. Federal Reserve on monetary policy. Some remarks made by the head of the Federal Reserve, Jerome Powell, have pointed to a potential cut in interest rates, which positively affected risky assets including Bitcoin. Nevertheless, the pullback below the 200-day moving average has worried some of the traders in the subsequent days.

Beside these events, traders are also watching other events including the performance of Nvidia Corporation, a firm in the artificial intelligence industry. The release of Nvidia’s earnings report may affect the investors’ sentiment towards risk assets such as Bitcoin.

My favorite chart on #Nvidia day: Nvidia stock could see a $309.7bn swing in market value after its Q2 earnings report as options pricing data suggests a potential 9.8% move in Nvidia’s stock in either direction. For once, #Finland‘s GDP is at stake. The Finnish economy is worth… pic.twitter.com/sy4eTGghL1

— Holger Zschaepitz (@Schuldensuehner) August 28, 2024

Although the price has fallen recently, there has been a rise in whale activities, especially the ones worth more than $100,000. As seen in the data, these transactions have been on the rise, which means that large holders are still buying more Bitcoin. This, combined with the current rising trading volumes, is suggestive of increased market participation as traders anticipate a possible recovery.