Solana (SOL) price has made quite a come back and is now trading at $154.55 from a low of $122 earlier this week. This can be attributed to the change of sentiment by the traders and investors which now appears to be bullish. Within the past day, SOL has surged by 12.29%, which points to high demand from investors.

SOL/USD 1-day price chart (source: CoinMarketCap)

This price increase happens after a general market crash where SOL had dropped to the $122 range, thus the recent growth is a testament to SOL’s strength and investor confidence. In addition, the market capitalization of Solana has also gone up by 105% which shows the positive price trend.

SOL Technical Analysis

The price at $155 has created a temporary resistance level that has been tested twice in the recent past, suggesting some hesitation. On the other hand, the $146 has been established as a key support level because it is expected that buyers will come in if the price falls.

Solana’s open interest (OI) has increased by more than 16% within the last 24 hours and now stands at $2.25 billion. This increase in OI suggests that there are more open positions in the market, be it long or short positions, suggesting that investors are more interested and confident in the market. However, this also reveals some possibility of increased volatility as the traders try to square their positions.

ETF Approval and Broader Market Impact

Solana’s recent bullish momentum is further supported by regulatory developments. The Brazilian Securities and Exchange Commission (CVM) has given the green light to the first Solana spot ETF.

🚨 BREAKING BIG:

Brazil’s Regulators have approved the launch of the world’s first spot $SOL ETF. pic.twitter.com/1ec9ftpCj1

— SolanaFloor (@SolanaFloor) August 7, 2024

This ETF, which is to be managed by QR Asset together with Vortx, is expected to list in the next ninety days subject to the approval by the Brazilian stock exchange; B3. The pricing benchmark for the ETF will be the CME CF Solana Dollar Reference Rate, which will be based on the trading data from the top crypto exchanges.

This approval is a major breakthrough as Solana becomes the first crypto asset to enter Brazil’s regulated investment market. This may lead to similar action in other areas, for example, in the United States, investment companies have already applied for spot Solana ETFs.

Future Price Movements and Investor Sentiment

Moving forward, traders will be eager to observe if Solana’s price will be able to break through the $155 mark. However, a sustained close above this level may pave way for further gains. On the other hand, a price drop to below $153 while the volume increases might put the price at the beginning of a bearish reversal with the nearest support at $146.

The sentiment of the market is still quite positive but with some degree of caution. The price of Solana is above the 200-day simple moving average (SMA), which is a sign of long-term bullish momentum. Also, the Solana’s Relative Strength Index (RSI) is at 47, indicating that there is no strong sell signal at the moment.

Source: X

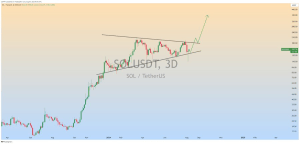

Analysts also note that Solana is now trading within a bullish pennant on the 3D timeframe. This pattern, where the trend lines are converging, usually suggests a period of consolidation before a breakout. Thus, taking into account the price movement, it is expected that Solana will break through the resistance level soon, which may provoke further growth.