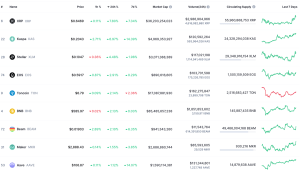

XRP is leading the gains on Wednesday as the wider crypto market experienced modest losses. XRP price is up 7.8% over the last 24 hours to trade at $0.6469 as of 5:00 am ET.

With this performance, the remittance token is the biggest gainer among the top 100 cryptocurrencies by market capitalization according to data from CoinMarketCap.

Top gainers July 31. Source: CoinMarketCap

In comparison, the global crypto market capitalization is down 0.71% on the day to rest at $2.39 trillion. Bitcoin is down 0.7% to $$66,289, and Ether’s ETH has dropped by 0.5% to $3,313 over the same time period.

What are the key levels to watch out for XRP in the long term?

At the time of writing, XRP was fighting resistance from the psychological level at $0.65. A daily candlestick close above this level would suggest the ability of the buyers to sustain the higher levels.

These bulls will then be bolstered to push the price first toward the bullish target of the symmetrical triangle at $0.6833 and later the March 13 high at $0.7334. Such a move would represent a 13% ascent from the current price.

XRP/USD four-hour chart. Source: TradingView

Supporting the bullish thesis for the XRP token was the position of the relative strength index (RSI) in the overbought region. The price strength at 70 suggests that the buyers are dominating the market.

Perhaps the most important technical indicator supporting XRP’s upward thesis is the major support zone between $0.55 and $0.53. Note that this is where the 50-day exponential moving average (EMA), the 100-day EMA and the 200-day EMA lie.

As such, any attempts to pull the XRP price below this zone would be met by intense buying from buyers congested around this level, who would want to increase their profits.

Other levels to watch on the downside are the psychological levels at $0.50 and $0.45.