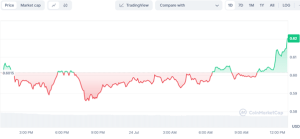

Zach Rector has outlined six fundamental reasons why XRP was about to boom in the next few weeks. The pair has been trading below the psychological $0.6 level but recently encouraged a bid to $0.6366, which was the highest level since April. Although the more comprehensive cryptocurrency market has seen a recent pullback, the analysis below by Rector is positive XRP. At press time, XRP was trading at $0.6203, a 2.35% surge from 24 hour low.

Source: CoinMarketCap

The biggest reason Rector remains as optimistic as ever is that the nearly four-year-old Ripple lawsuit may finally close. Indeed, in a recent TV interview, Ripple CEO Brad Garlinghouse said one is expected “very soon.” This comes after the July 2023 revelation that XRP is not a security, which saw the price of XRP double within 24 hours.

Potential Catalysts for XRP’s Price Increase

Another reason that signals a bullish outlook is the possibility of a further increase in the adoption of XRP within the U.S. now that the lawsuit is behind them. The chief executive officer is quoted as saying Ripple’s XRP-based payment solution will give massive support for use and adoption when it opens up for customers in the U.S.

Additionally, its stablecoin, RLUSD, is set to launch soon, available on both the XRP Ledger and the Ethereum blockchains. The Ripple executives, led by their CEO Garlinghouse and CTO David Schwartz, have previously indicated how RLUSD will benefit XRP.

6 Reasons #XRP will pump 👇 pic.twitter.com/pKQXf6qEAD

— Zach Rector (@ZachRector7) July 24, 2024

The next catalyst is the expected arrival of XRP ETFs. These instruments are available in Europe at the moment and after the recent approval for them to be listed in the U.S., XRP could see more value gains as the liquidity improves. Strong U.S. regulations on cryptocurrencies that could favor XRP, given the firm’s compliance-first approach, are also expected to occur after the ongoing U.S. elections.

Rector further says that if the U.S. presidential elections do not turn out as expected-which might be big trigger-continued money printing is enough cause for investors to seek some safe havens such as crypto assets. Inflationary pressure derived from here might push for a more bullish XRP. He, therefore, advises XRP faithfuls to stack more as they count on a possible rise.

Technical Analysis and Whale Accumulation

Technical analysis shows that XRP’s price action moves closer to an important breakout area. Since 2017, XRP has traded within a symmetrical triangle range flanked by descending trendline resistance and ascending trendline support. Now that the triangle apex is in sight, breakouts could help prices forecast towards $0.86 in Q4 2024, with more attempts to hit $1.

On other accounts, technical tools reveal the same optimism about this asset’s future. The relative strength index (RSI) on the weekly chart is bouncing off the 50 level in a sign that buying pressures are increasing. In normal price action, it is most times justified to have increased trading volumes around important price levels captured in the volume profile before a sustained move starts to take effect.

On-chain data provided by Santiment shows the massive accumulation of XRP by whale cohorts. The supply of XRP held by its richest cohort—that holds over 1 billion tokens—has spiked, implying strong confidence in the future price potential of XRP. The accumulation trend is also noted in other whale cohorts, giving a more general market optimism.